Employment & Public Support: Impacts from R&D and Green Fiscal Incentives

By Ester Martínez-Ros

Public funds are critical to help us transform into a greener and more sustainable economy. In Spain, the use of green and technological innovation tax credits created spillover benefits on employment for MSMEs (or micro firms) and SMEs. We hope this lesson from the past can help shape a better future direction for green fiscal policies where the countries can further innovate and leverage existing technologies to transition into the new world that is safer, greener and sustainable for all.

Public programs and incentive policies are needed to drive R&D and investments in green innovations

Many environmental issues, such as climate change, GHG emission, and environmental degradation, remain one of the most pressing issues. In today’s world, it is not enough just to satisfy both economic and green goals to respond to vigilant pressure to be green, but there is also the need to innovate to transition to the new normal, to further drive efficiency and to find new ways of generating revenues in this extremely dynamic environment.

Market imperfections create conditions where optimum level of innovation cannot be attained unless public policies are put in place to stimulate innovation (Porter & van der Linde, 1995; Rennings, 2000; OECD, 2011). Especially for green innovations that face two externalities of an innovation externality and an environmental externality, technology-push and market-pull factors alone do not provide enough incentives (Rennings, 2000). Sustainable growth requires necessary policies, supporting institutions, ecological ambition, innovation, and advanced skills.

Tax incentives and direct funding have been two most widely used policy instruments to drive sustainable development

Specific to technology and innovation policies, tax incentives (i.e., exemptions, credits, and accelerated depreciations) and direct funding are two most widely used policy instruments to motivate private entities to be environmentally responsible. Tax incentives are more market friendly than direct funding. Additionally, tax incentives have lower administrative burden and help to reduce the risk of “picking losers” more than direct funding instruments (Dechezleprêtre et al., 2016). Most OECD countries have been employing tax incentives as they found that tax credits have been providing higher return to innovation efforts, maintaining positive spillovers, benefiting the economy as a whole (OECD, 2011).

Spillover benefits from tax credits on employment: The case of Spain

We analyzed the effect of Environmental Innovation (EI) and R&D and technological innovation (R&D&I) tax credits on employment level for firms of different sizes in Spain. Spain provides an interesting context. Though Spain has pushed strongly forward with sustainable strategy plan through increased government expenditure on environmental protection via its stronger environmental policies, its revenue from environmentally related tax as a share of GDP has declined since 2000.

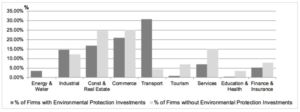

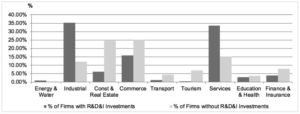

The analysis of over 170,000 firms is based on 2008 corporate tax records by the Institute of Fiscal Studies (IEF) of the Ministry of Finance and Public Administration of Spain. The dataset contains records of firms that opted for the Régimen Especial de Empresas de Reducida Dimensión, directed at small firms. We focus on small firms as they are the backbone of an economy (Baumann and Kritikos, 2016) but often are typically left out of analyses. Approximately 97% of firms in Spain in 2008 had 19 employees or fewer (INE, 2009). Interestingly, Spanish SMEs (more than 10 employees) have been responsible for more than half of corporate R&D investment, a trend that is contrary to most other OECD countries (INE, 2010; OECD, 2015). Figure 1 and 2 illustrate percentage of firms with EI and R&D&I tax credit by sector.

Figure 1: Firms with EI Tax Credit by Sector

Figure 2: Firms with R&D&I Tax Credit by Sector

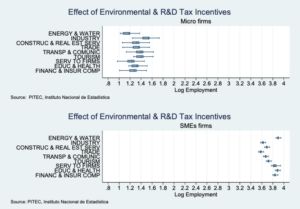

Our result is the first that illustrates the relationship between the two types of tax incentives on employment. It shows that there are positive relationships between employment and EI and R&D&I tax credits for both MSMEs and SMEs. With both tax credits combined, the magnitude is larger for MSMEs than for SMEs (Figure 3). The impact is stronger for industry sector for MSMEs, but the impact is stronger for energy & water, and service sectors for SMEs. When testing the joint effect, results show that the impact of both tax credits on employment are independent of each other for both MSMEs and SMEs.

Figure 3: Employment impact of EI and R&D&I tax credits for MSMEs and SMEs

Our results confirm that there are added benefits from tax incentive schemes than originally intended. Nonetheless, results must be carefully interpreted as net changes in employment depend not only on green policies, but also on other factors such as how labor market functions (OECD, 2014), how revenues from other environmental taxes are used (Bowen, 2012), and nature and complexities of the green fiscal instruments themselves.

The government must remain engaged in both green and technology policies to ensure policy intervention schemes are powerful and effective.

Technological change does not exist in a vacuum (Jaffe et al., 2005). Green policies and incentives are major drivers and shapers for sustainable development. A body of research (e.g., Hall and Lerner, 2010) provides a solid ground for designing appropriate policies to support innovation; however, laws and policies cannot keep pace with technological developments. The gaps are getting wider in all technological domains (Martinez-Ros and Kunapatarawong, 2019). Furthermore, the past has shown that successful implementation is not an easy task, resulting in unintended mistakes in policy design and implementation. Given the relatively low share of firms that adopt EI in Europe, there is still room for higher green innovation adoption and diffusion in many countries, especially the laggard countries (EEA, 2014).

To have more effective public support programs, policy makers need to consider not only how to incentivize green capabilities at firm-level but also on how green capabilities impact labor at the micro- and macroeconomic levels. Policies need enhance a stronger synergy between green innovation and employment, taking into account the heterogenous characteristics of the types of green innovations, firms, sectors, countries and regions (Triguero et al., 2017). For instance, policy makers can design policies that help guide firms to craft the strategy where the choice of their green innovation will increase firm growth both in terms of returns and employees. The public support to further invest in R&D, develop green skills (OECD, 2012) and the requirement for firms to implement the Environmental Management System (EMS) (Cecere and Mazzanti, 2015) are also crucial steps towards achieving smarter growth (fostering knowledge), more sustainable growth (greener world while boosting competitiveness), and more inclusive growth (enhancing labor market participation) (Triguero et al., 2017).

We hope the results from this study would provide additional insights into how to create better-designed regulations that can maximize co-benefits for firms and society alike.

References

- Baumann, J. and Kritikos, A. S. (2016), “The link between R&D, innovation and productivity: Are micro firms different?”, Research Policy, 45(6): 1263-1274.

- A. (2012), “Green growth, green jobs and labor markets”, Policy Research Working Paper 5990, Washington, D.C.: World Bank.

- Cecere, G., and Mazzanti, M. (2015), “Green jobs, innovation and environmentally oriented strategies in European SMEs”, SEEDS Working Paper 21/2015.

- Dechezleprêtre, A., Einiö, E., Martin, R., Nguyen, K. T. and Van Reenen, J. (2016), “Do tax incentives for research increase firm innovation? An RD design for R&D”, National Bureau of Economic Research, w22405.

- EEA (2014), Resource-efficient Green Economy and EU Policies, n. 2, Copenhagen: European Environmental Agency.

- Hall, B. and Lerner, J. (2010), “Financing R&D and innovation, Chapter 14.” In B.H. Hall and N. Rosenberg (eds.), Handbook of the economics of innovation, Amsterdam: Elsevier, 609-639.

- Instituto Nacional de Estadística (INE) (2009), España en Cifras, INE, Madrid

- Instituto Nacional de Estadística (INE) (2010), España en Cifras, INE, Madrid

- Jaffe, A. B., Newell, R. G. and Stavins, R. N. (2005), “A tale of two market failures: Technology and environmental policy”, Ecological Economics, 54: 164-174.

- Martínez, E., and Kunapatarawong, R. (2019), “The impact of innovation and green fiscal incentives on employment in Spain”, Hacienda Pública Española/ Review of Public Economics, 231-(4/2019): 125-154.

- OECD (2011), Towards Green Growth: A Summary for Policy Makers, Paris: OECD Publishing.

- OECD (2012), The Jobs Potential of a Shift towards a Low Carbon Economy, Final report for the EC, DG Employment, OECD, Paris.

- OECD (2014), OECD Addressing Social Implications for Growth. Session 2, Inclusive Labor Markets for Green Growth, Green Growth and Sustainable Development Forum, 13-14, November 2014, Paris, Paris: OECD Publishing.

- OECD (2015), Environmental Performance Reviews: Spain 2015, Paris: OECD Publishing.

- Porter, M. E. and Van der Linde, C. (1995), “Green and Competitive”, Harvard Business Review, 1995: 120-134.

- Rennings, K. (2000), “Redefining innovation – eco-innovation research and the contribution from ecological economics”, Ecological economics, 32(2): 319-332.

- Triguero, A., Cuerva, M.C., and Álvarez-Aledo, C. (2017), “Environmental Innovation and Employment: Drivers and Synergies”, Sustainability, 9, 2057.